Home Companies Kill Venture Capital Circle, Dongpeng, Suofeiya Home Collection, Mongnls As LP

ໃນເດືອນກໍລະກົດ 16, Dongpeng Holdings and Suofeiya Home Collection announced one after another, Suofeiya Home Collection Investment, Ningbo Yingfeng, Dongpeng Investment, and Guangzhou Emerging Industry Development Fund signed the Partnership Agreement, agreed to jointly invest in the establishment of Guangzhou Zhe Ling Industry Investment Fund Partnership (Limited Partnership) (“Guangzhou Zhe Ling Fund”). Its executive partner is the United States “less east” in the hands of He Jianfeng Ningbo Yingfeng.

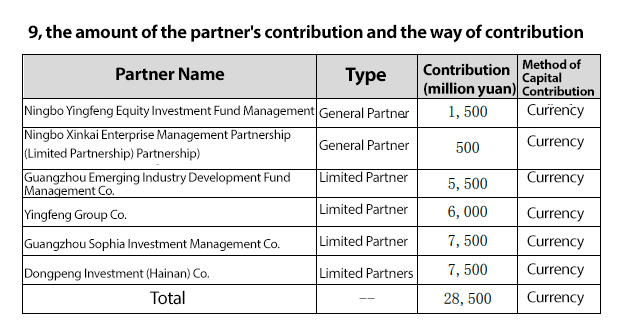

Enterprise data show that on July 14, Guangzhou Zhe Ling Industrial Investment Fund Partnership (Limited Partnership) was established. Its executive partner is Ningbo Yingfeng Equity Investment Fund Management Co. It has a registered capital of RMB 285 million. Its business scope includes: engaging in equity investment, investment management, asset management and other activities with private equity funds.

The fund’s investment scale is reportedly targeted at 500 million RMB. The first round is subscribed by Suofeiya Home Collection Investment, Ningbo Yingfeng, Dongpeng Investment, Ningbo Xinkai, Yingfeng Group and Guangzhou Xinxing Fund to Guangzhou Zhe Ling Fund. It has a total contribution of 285 million RMB, of which Suofeiya Home Collection Investment and Dongpeng Investment each contributed 75 million RMB. The fund will realize investment income by investing in high quality enterprises with unique competitive advantages in the field of new generation information technology and listing/selling out after integration and value enhancement. Focus on investing in the new generation information technology field in the “Guangzhou Emerging Industries Catalogue”, and the scale of investment in the new generation information technology field will not be less than 60% of the scale of Guangzhou Zhe Ling Fund.

Three home listed companies to do LP home companies to kill the venture capital circle

Within a short period of half a month, three listed companies of home furnishings do LP (Limited Partner). Just two days before the announcement of Suofeiya Home Collection and Dongpeng, on July 14, Mongnls issued an announcement that Guangdong Mongnls Industrial Investment Fund Partnership, an industrial fund to be invested by the company, intends to subscribe to the capital contribution share of Guangdong Guangqi Zhixing Wu Equity Investment Partnership with its own capital of RMB 10 million and become a limited partner of the partnership. After the completion of this investment, Mongnls Industry Fund will hold 5.5249% of the partnership’s capital contribution and signed the Guangdong Guangqi Zhixing Wu Equity Investment Partnership Agreement with each partner on July 13, 2022.

According to the information, the fund will mainly invest in automotive upstream chip semiconductors, new energy vehicles and other related fields. The investment method is direct or indirect investment in non-listed companies equity investment, venture capital and other investments.

Earlier, Kitchen News noted that conglomerates will continue to develop their consolidation strategies, while emerging companies seek to accelerate growth and expand their scale.

Expansion is not a form of M&A. The M&A process is often treacherous. In the absence of liquidity, they can only raise capital through fixed income and other means. Raising capital is becoming increasingly difficult today. In addition to M&A, companies can expand discreetly by doing LPs and other ways.

To cope with this round of global economic crisis and the increasingly tight liquidity problem, while holding cash in hand for the winter, use smaller funds to leverage more resources. This is also the flexible side of the LP investment approach. ໃນເວລາດຽວກັນ, the LP approach has a broader investment scope and lower risk of taking on the liabilities of the underlying company.

Such as Koda down to invest in the lithium industry. Outside of finance, consumer and Internet, home furnishing companies are becoming a new force of tiny investment. This force will form the energy to promote the high-quality development of the home furnishing industry in the future, to realize the capital cycle of “industry – capital – industry”.

ຜູ້ຜະລິດ Faucet VIGA

ຜູ້ຜະລິດ Faucet VIGA