Kitchen & Bath Headlines

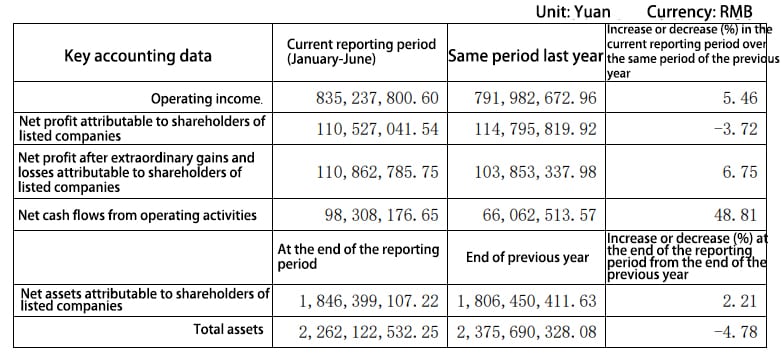

In the second half of August, the sanitary industry related listed companies have announced the 2020 semi-annual report. Affected by the epidemic, a number of enterprises in the first quarter of a large decline, the second quarter gradually returned to normal operations. Even so, the first half of the sanitary ware companies or out of a very different growth route, such as Huida bathroom, R & T and other companies revenue and net profit declined; Diou home in revenue and profit two financial indicators are to achieve growth; Seagull Sumitomo although revenue increased, but net profit recorded a large drop. Obviously, the epidemic brings different trials and opportunities for each company.

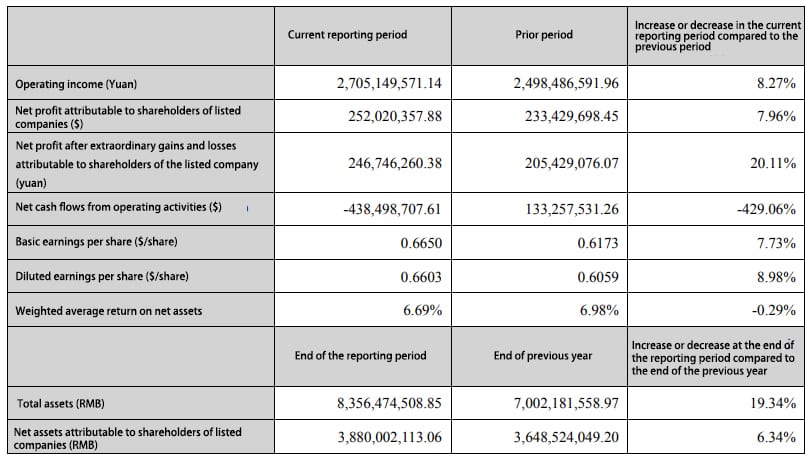

| Company Name | Operating income (billion yuan) | year-on-year increase | Net profit (billion yuan) | year-on-year increase |

| Huida | 13.17 | -11.16% | 1.28 | -9.99% |

| Solux | 8.35 | 5.46% | 1.11 | -3.72% |

| Seagull Housing | 13.21 | 10.71% | 0.41 | -24.50% |

| Diou Home | 27.05 | 8.27% | 2.52 | 7.96% |

| R&T | 4.62 | -10.98% | 0.45 | -43.70% |

| Oppein Home | 49.66 | -9.88% | 4.89 | -22.70% |

(Note: Health enterprise half-year report, based on the half-year report of each enterprise)

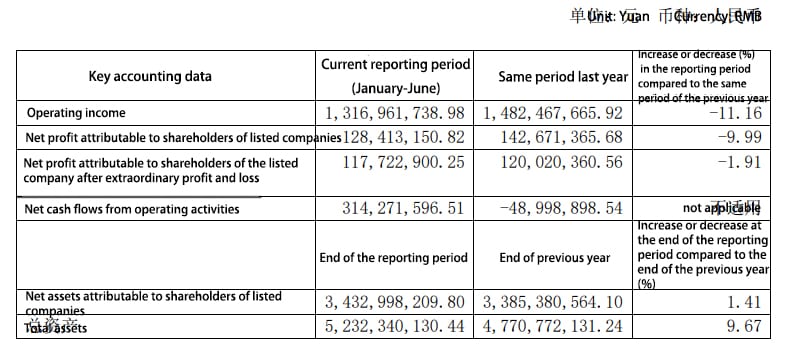

Huida Sanitary.

Retail Channel Down, Engineering Channel Up

August 25, Huida bathroom announced the 2020 half-year report.From January to June 2020, Huida bathroom achieved operating income of RMB 1.317 billion, a year-on-year decrease of 11.16%; net profit attributable to shareholders of listed companies of RMB 128 million, a year-on-year decrease of 9.99%; basic earnings per share of RMB 0.3476, a year-on-year decrease of 9.99%.

According to the announcement, Huida bathroom in the first half of the domestic market achieved operating income of RMB 949 million, a decrease of 10.89%, of which the first quarter decreased by 32.84%, the second quarter returned to growth, with a growth rate of 6.58%. Huida bathroom domestic business is divided into retail channels and engineering channels, the two channels contributed revenue of RMB 608 million and RMB 341 million respectively. . Foreign, first-half operating income of RMB 368 million, of which the first quarter down 2.72%, the second quarter down 18.88%, an overall decline of 11.75%.

Huida bathroom in the first half of the domestic engineering channel revenue was basically flat last year, showing a good momentum of development. It is reported, Huida bathroom engineering channel using the company’s own plus dealers regional landing mode, has been with R&F Properties, Poly Developments and Holdings, Kangqiao Real Estate, Aoyuan Group, Wanda Group. Sinoocean Group Holdings, Beijing Capital Land, Zhong’ang Real Estate and other well-known real estate reached a strategic cooperation. In addition, the first half of Huida Sanitary also with Jiangsu Golden Horse Transport, Xinjiang Huayuan Holdings and other construction real estate industry companies signed a cooperation agreement, officially launched the “Huida Sanitary – new infrastructure industry alliance”.

Stores, as of June 30, 2020, Huida bathroom with a total of 2,831 domestic stores, with a total area of 484,800 square meters, of which “Huida” brand bathroom products 1799 stores, with a total area of 332,400 square meters;” Huida bathroom with a total of 2,831 stores, with a total area of 332,400 square meters. Huida” brand tile products 396 stores with a total area of 91,300 square meters; “Dufrene” brand stores 636 stores with a total area of 61,100 square meters.

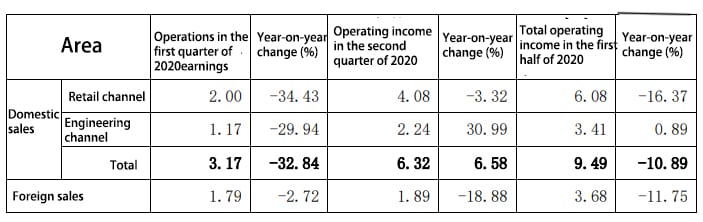

Solux.

Revenue Up 5.46%, Net Profit Down 3.72%

According to the semi-annual report, Solux achieved operating income of RMB 835 million in the first half of 2020, an increase of 5.46% year-on-year, but the net profit attributable to shareholders of listed companies fell by 3.72% to RMB 111 million in the same period, Solux said that the new crown epidemic caused a big impact on the global economy, but the impact on the company as a whole is limited, and several hotspots such as contactless, antibacterial, filtration, etc., have been affected by the epidemic. The demand for themed products, such as induction faucets, increased significantly. On the basis of the steady development of the original categories, the company continues to actively promote the category IDM strategy, and the layout of new business and new categories has achieved remarkable results.

Solux’s business is divided into two categories according to its positioning: IDM business of categories and “Solux-Home” business. The “Solux-Home” model will provide target customers with one-stop products and services from interior design and decoration to whole house customization and soft furnishings, etc. The first “Solux-Home” will be opened in Xiamen in the first half of 2020.

In the first half of the year, Solux invested RMB 110 million to establish a wholly-owned subsidiary, Solux Building Materials Co. In addition, Solux also made two major non-equity investments in the first half of the year, namely, the “relocation and expansion project of faucet and shower system” and the “expansion and technical improvement project of showerhead and its accessories”, with a cumulative investment of over RMB395 million as of the end of June.

Seagull Sumitomo.

Net Profit Down Over 20%

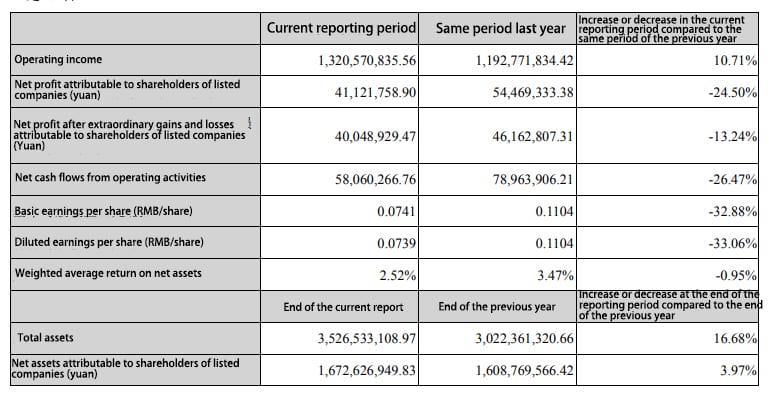

From January to June 2020, Seagull Sumitomo achieved an operating revenue of RMB1,321 million, up 10.71% year-on-year. Despite the increase in revenue, net profit attributable to shareholders of the listed company fell 24.50% to RMB41 million and basic earnings per share narrowed to RMB0.0741 from RMB0.1104 in the same period of 2019.Seagull Sumitomo said that the first quarter was affected by the epidemic, but operating income in the second quarter rose 90.95% year-on-year, up 34.40%, achieving significant growth.

By product, hardware faucet products contributed revenue of RMB 852 million in the first half of the year, accounting for 64.53% of total revenue, the smart home, bathtub ceramics, bathroom and custom cabinets accounted for a single-digit percentage of total revenue, of which Seagull Sumitomo’s bathroom business, which has been actively developing in recent years, accounted for 6.49% of total revenue, reflecting the huge room for development.

Geographically, Seagull’s domestic and international revenue accounted for 41.59% and 58.41% of its total revenue in the first half of the year, respectively. Compared to the previous year, domestic revenue increased by 40.32%, while foreign revenue declined by 3.75%.

In the first half of the year, Seagull Sumitomo’s major capital move was the acquisition of 100% of the shares of Kezhu Integration. At the same time, Seagull’s holding subsidiary Suzhou Seagull Nestlé changed its name to Suzhou Seagull Nestlé Housing Technology Co. “, marking the nesting business from the whole bathroom to the home fully installed, accelerating the process of industrialization of the company’s residential interiors.

Diou Home.

Double Growth In Revenue And Net Profit

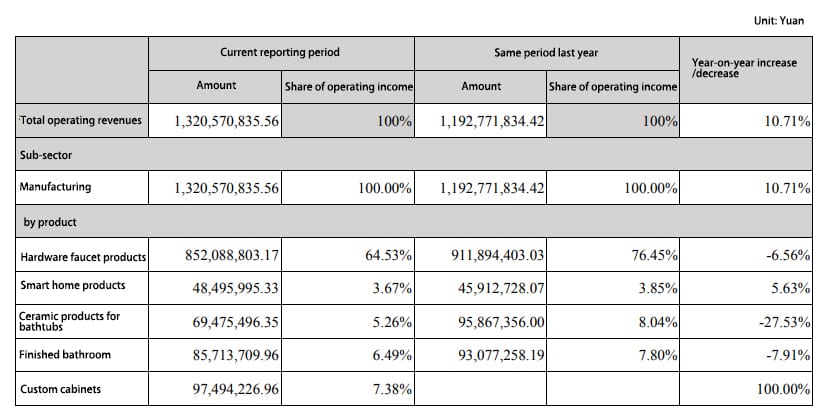

In the first half of 2020, Diou Home furnishing achieved operating income of RMB 2.705 billion, up 8.27% year-on-year, and net profit of RMB 252 million, up 7.96% year-on-year, which is one of the few companies in the sanitary ware and home furnishing industry that achieved both operating income and net profit growth.

Diou’s business mainly involves tiles, sanitary ware and acrylic panels. In the first half of the year, the revenue of sanitary products was RMB182 million, a decrease of 10.04% year-on-year. In comparison, revenue from ceramic wall and floor tile products increased by 10.16% to RMB2,456 million.

At present, Diwang Sanitary Ware already has large real estate developer customers including Bi Guiyuan, Rongchuang, Longhu, Yaju Le, etc., and in the first half of the year, it has successively built cooperative relationships with real estate developer customers such as Greenland, Hefei Taifu, and Langi.

Focusing on capacity expansion, Chongqing Diwang continued to promote the construction of the first phase of the smart sanitary ware production base located in Yongchuan National High-Tech Park in Chongqing, the new ceramic sanitary ware production line, laying the foundation for building the supply chain of ceramic sanitary ware. At present, the first phase of the production line of intelligent sanitary ware in Chongqing has been completed and put into operation.

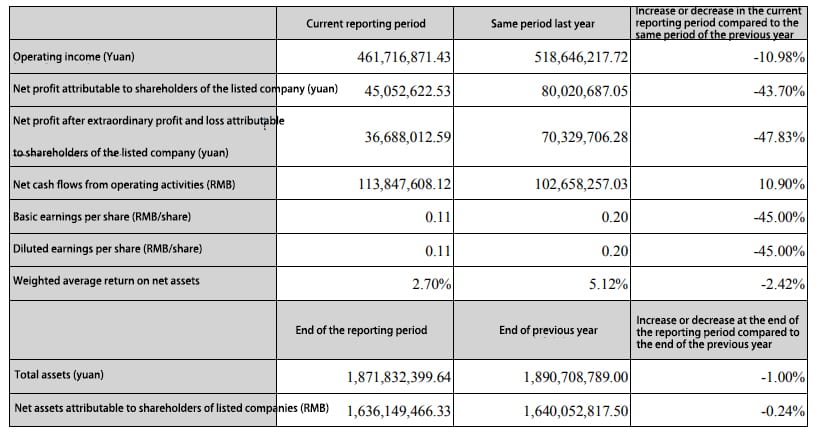

R&T.

Significant Decrease In Net Profit Of 43.70%

On August 24, R&T announced its semi-annual report for the year 2020.From January to June 2020, R&T achieved operating revenue of RMB462 million, down 10.98% year-on-year, and net profit attributable to shareholders of the listed company of RMB45 million, down 43.70% year-on-year. 25.99% and then gradually recovered to increase operating income by 3.5% in the second quarter compared to the same period in 2019.

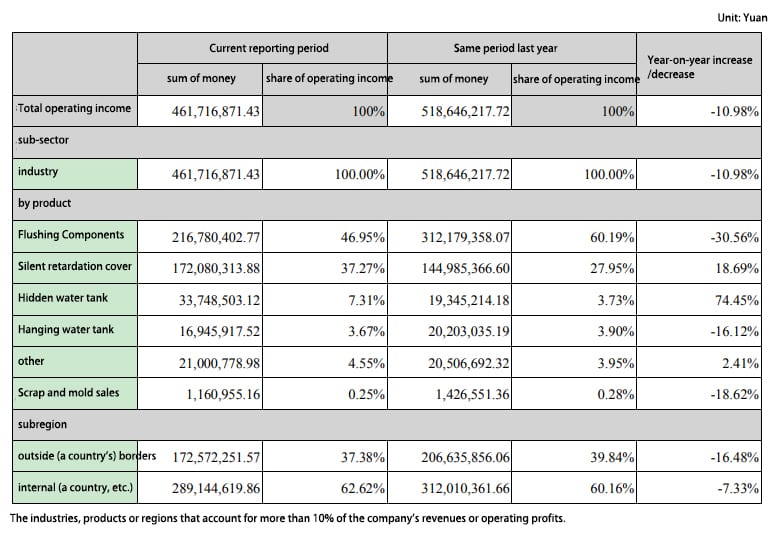

R&T’s main products are flush components and silent slow-drop covers, with revenue from the two categories accounting for 46.95% and 37.27% of the company’s total revenue. Compared to the same period in 2019, the flush assembly revenue share declined, while the silent retardation cover increased, with the two categories accounting for 60.19% and 27.95% of the Company’s total revenue share, respectively, in the prior year period. In addition, the remaining categories by revenue share are hidden water tank (7.31%), other (4.55%), hanging water tank (3.67%).

By region, R&T’s revenue declined in both domestic and overseas markets in the first half of the year, by 16.48% and 7.33%, respectively. According to the announcement, R&T’s customers include well-known foreign bathroom companies such as Roca, Inez, Kohler and American Standard.

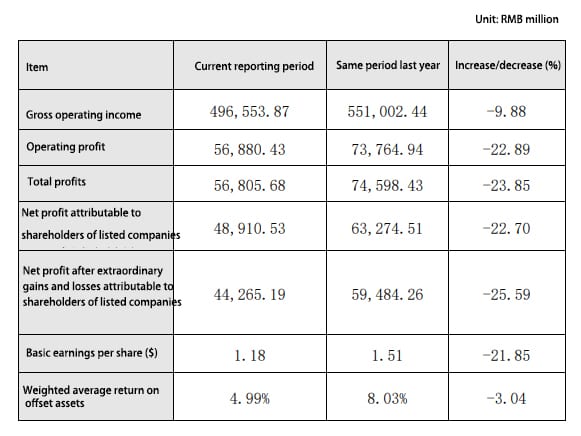

Oppein Home.

Net Profit Decreased By 22.70% Year-On-Year

According to Oppein Home’s previously announced results, the company’s operating revenue and net profit in the first half of 2020 fell by 9.88% and 22.70% to CNY4.966 billion and CNY489 million, respectively, and basic earnings per share shrank to CNY1.18 from CNY1.51 in the same period last year.

Oppein Household said that the impact of the epidemic, the first half of the housing sales transactions and delayed demand for renovation, the decline in demand for household products, the epidemic superimposed on the consumer environment changes on the custom home furnishing industry impact is more obvious. In addition, in recent years, hardcover and installed channels to enhance the proportion of home furnishing retail market pattern has brought major changes, on the one hand, the cabinet, bathroom and other retail furniture market share by hardcover squeeze obvious, on the other hand, fully customized (wardrobe) as a home decoration of the flow entrance position more prominent.

VIGA Faucet Manufacturer

VIGA Faucet Manufacturer