Mr. Kitchen & Bath Kitchen & Bath Headlines

According to a research report from Research And Markets, the global smart home market will increase from $78.3 billion to $135.3 billion from 2020 ny 2025, with a compound annual growth rate of 11.6% in the next five years, so the market potential is huge. Recently, the smart home market has seen a lot of action: Midea Group and Hikvision are spinning off their smart home businesses and are lining up to go public; Qingdao Eoroom Smart has also started its IPO; in addition, newcomers represented by Orvibo are also speeding up in the smart home market, and the next smart home giants will be born among these companies.

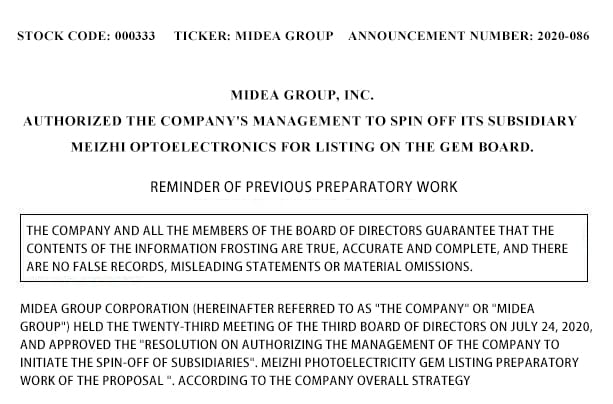

Midea Group/Meizhi Optoelectronics

On July 27th, Midea Group (000333.SZ) announced that it plans to spin off its subsidiary Meizhi Photonics Technology Co Ltd (hereinafter referred to as “Meizhi Photonics”) to list on the Growth Enterprise Market (GEM). Meizhi photoelectric business development needs, in order to further promote the growth of Meizhi photoelectric business, standardize governance operations and broaden financing channels, combined with Meizhi photoelectric own industry, the main business situation and future business planning and development strategy.

Meizhi Photoelectric was established in 2001 with a registered capital of RMB 100 TAPITRISA. Its main business scope includes smart home consumer device manufacturing, smart home consumer device sales, digital home product manufacturing, artificial intelligence application software development and Internet of Things technology research and development. In order to smoothly push Meizhi Optoelectronics onto the GEM board, Meizhi Optoelectronics launched a diversified employee stock ownership plan on July 4. After the implementation of the shareholding plan, Midea Group will directly or indirectly hold 56.7% equity interest in Meizhi Optoelectronics.

Financial data shows that in the first quarter of 2019 SY 2020, Meizhi Optoelectronics will complete operating income of 713 million yuan and 91,407,900 yuan, and achieve net profit of 24,533,200 yuan and 4,256,500 yuan. And in the three reporting periods from 2017 ny 2019, Midea Group’s net profit attributable to its mother was 17.284 trillion yuan, 20.231 billion yuan and 24.211 trillion yuan, and its net profit after deduction was 15.614 trillion yuan, 20.058 billion yuan and 22.724 trillion yuan, respectively.In 2019, Midea Group’s net worth is about 30.195 trillion yuan, Meizhi Optoelectronics’ Net assets are approximately $622 TAPITRISA.

Hikvision

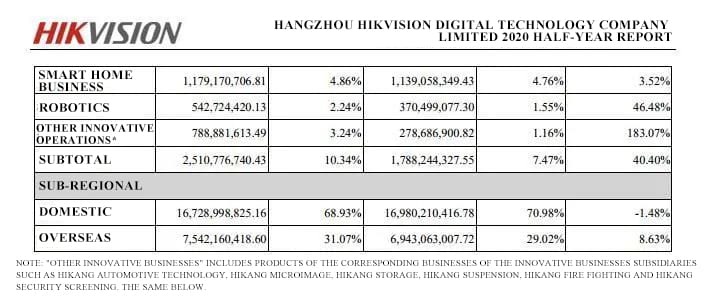

Hikvision (002415.SZ) revealed in its 2020 half-yearly report released on July 25 that Hikvision started preparations for the spin-off of its smart home business. Meanwhile, Hikvision’s robotics, automotive electronics, smart storage, and Hikvision Microimage businesses are also continuing to develop rapidly. Although Hikvision’s smart home business is about to go public, the smart home business does not account for a high percentage of revenue in Hikvision’s business segment.

The semi-annual report showed that the smart home business achieved an operating income of 1.179 trillion yuan, up 3.52% year-on-year, with revenue accounting for 4.86%. This business is developing better in 2019 than this year, with year-on-year revenue growth of up to 58.38% last year. The gross profit margin of the smart home business was 37.11%, which is in the middle to low level among Hikvision’s various product businesses and 12.65 percentage points lower than the overall gross profit margin.

Haier Group / Eoroom Smart

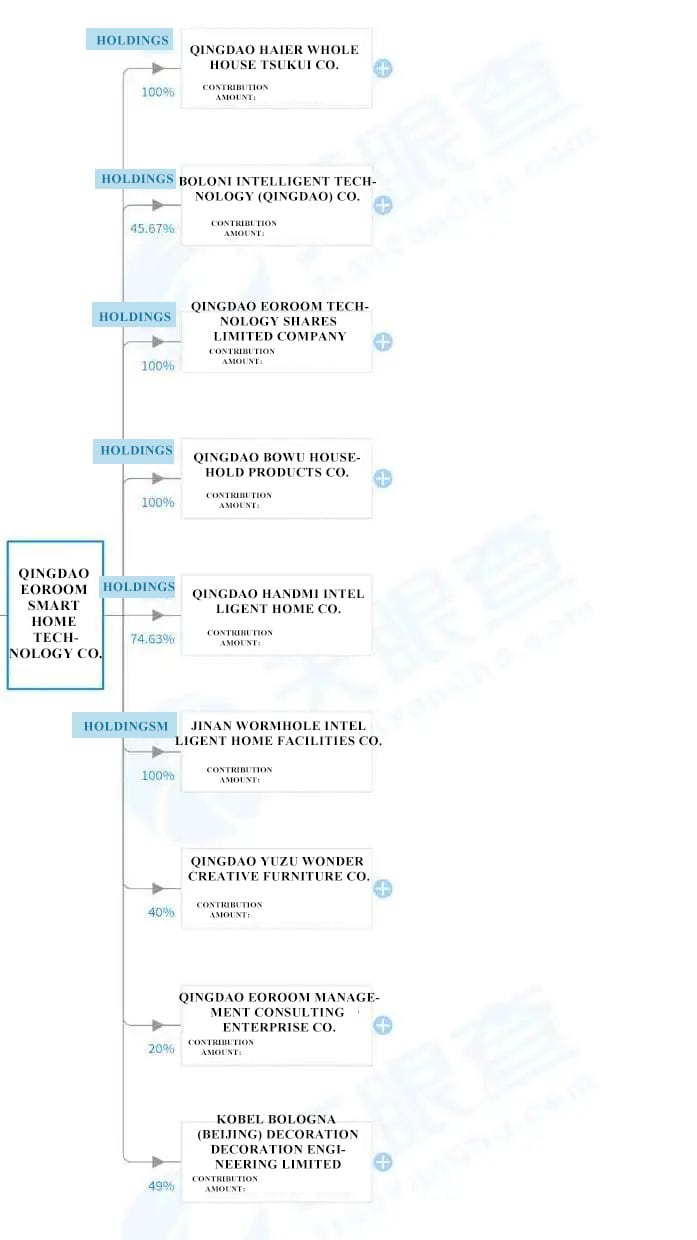

(hereinafter referred to as “Eoroom Smart”), Eoroom Smart officially entered the IPO counseling period and intends to land on GEM in September this year. As a core enterprise in the smart home ecosystem, the capital behind Eoroom Smart is Haier Group, and this IPO may add another listed company in the smart home business for Haier.

Eoroom was founded in September 2001, and its main business includes design, production, installation and sales of supporting appliances and components for kitchen cabinets and other kinds of home improvement products, and it has invested in nine enterprises. Among them, Qingdao Eoroom Technology Company Limited (hereinafter referred to as “Eoroom Technology”) was established in 2015 as the main business entity under Eoroom Smart Home, which was initially established as a wholly-owned subsidiary of Qingdao Haier Home Integration Company Limited.

At the end of 2017, Eoroom Technology underwent a shareholding change and its shareholder was changed from Qingdao Haier Home Integration Co. Ltd. to Qingdao Haier Kitchen Facilities Co. Ltd. which is the predecessor of the current Eoroom Smart. Amin'izao, Eoroom Technology has a number of first-tier brands under its umbrella, including Eoroom Wormhole, Haierhome Haierhome, Bologna, hyrock Creative Home, etc., which has formed a diversified industry pattern.

Orvibo

Shenzhen Orvibo Technology Co., Ltd. (Orvibo) has been coached by Shenvan Hongyuan Securities Underwriting and Sponsorship Co.

Orvibo was founded in 2011, and its products include smart switches, smart door locks, smart sockets, smart curtains, security sensors, sns. The company is committed to interoperability and has built seven systems including smart control center, smart lighting system, HVAC system, smart security system, energy management system, smart audio-visual system, door and window shading system, sns. The application scenarios are mainly smart home, smart office and smart hotel.

It is noteworthy that after its establishment in 2011, Orvibo has received successive rounds of financing from 2014 ny 2016, as well as in 2019, with investors including Midea Property, Red Star Macalline, Evergrande Group, sns. The data released by Orvibo after the Pre-IPO round of financing shows that its products have entered 2 TAPITRISA + households, covering 500 million+ users, connected over 8 million IoT devices, and pioneered 150 smart real estate projects. In terms of channels, Jiangxin has opened 300 stores nationwide and has more than 1,000 sales and service outlets.

Jiangxin Smart

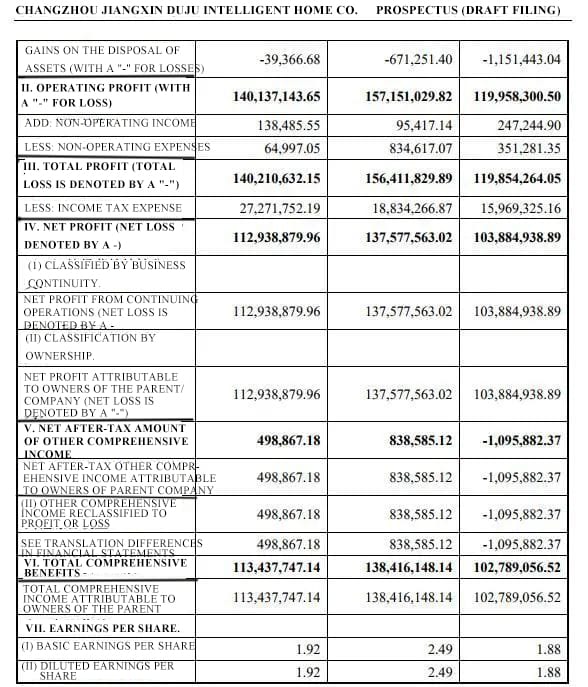

Changzhou Craftsmanship Smart Home Co. (hereinafter referred to as “Jiangxin Intelligent”) made its initial public offering (IPO) and was listed on the Growth Enterprise Market (GEM) on August 6. High-tech enterprise. According to the prospectus, Jiangxin Smart has spent more than 5.5% of its revenue on R&D for three consecutive years and owns 92 domestic and foreign patents, including five invention patents. The average value of R&D as a percentage of revenue in the domestic smart home industry in FY2019 was 3.34% and Jiangxin unique was 5.68%, two percentage points higher than the industry.

In 2017, the total assets of Jiangxin Smart were $761,051,400, in 2018, $930,944,800, and in 2019, $1,059,596,400; the net profit was $103,884,900 in 2017, $135,757,600 in 2018, and in 2019 Net profit was $112,938,900, with total assets and net profit continuing to rise.

As the world’s second-largest smart home market, Chinese consumers have been maintaining strong demand for smart devices, attracting an army of players to the smart home track. Mobile phone manufacturers are seeking new growth points, and traditional home appliance manufacturers are actively promoting intelligent transformation. Mandritra izany fotoana izany, Internet manufacturers with a large user base, voice intelligent technology and smart speakers combined to cultivate the ecosystem, and compete for the entrance to the family. In the future, in the smart home circuit, there may be more “Haier smart home”.

VIGA Faucet Manufacturer

VIGA Faucet Manufacturer