On 10 September local time in the US, FGI Industries (“FGI“), a supplier of kitchen and bathroom products to ForemostGroups Ltd (ranked 56th in US household companies), filed for an IPO with the US Securities and Exchange Commission and is expected to The IPO is expected to take place on the NASDAQ in late September. The initial proceeds of $18 million will be used for potential acquisitions or other strategic capital allocation priorities as well as working capital and general corporate purposes.

Founded in 1987, FGI sells complete sanitary ware, including toilets, sinks, bathroom cabinets, showers and smart toilets. Most of the products are OEM for Chinese sanitary ware companies. Its own brands include the retail brand Foremost ®, the wholesale focused contrac ® and the Jetcoat brand.

According to the FGC Group’s announcement on 27 July, FGC Group strategically combined its global kitchen and bathroom businesses into one company (FGI Industries) and focused on brand building, sales and marketing and access for K&B as a NASDAQ-listed entity. All indoor and outdoor home furnishings businesses and manufacturing divisions will remain in the original ForemostGroupsLtd. There are also plans to pursue a public listing of ForemostGroups Ltd in Taiwan.

The prospectus shows that FGI had operating revenue of US$78,866,047 and a net profit of US$5,469,315 at the end of June, operating revenue of US$134,827,701 and a net profit of US$4,730,748 in 2020.

Sales revenue from sanitary ware for the first half of the year was US$43.53 million, up 5.1% year-on-year and accounting for 55.2% of total revenue. Bathroom furniture sales for the first half of the year were US$27.44 million, an increase of 53.1% year-on-year and accounted for 34.8% of total revenue.

| For The Six Months Ended 30 June | Increase | ||||

| 2021 | Percentage | Year 2020 | Percentage | Percentage | |

| USD | % | USD | % | % | |

| Sanitary Ware | $43,535,82 1 | 55.2 | 41,432,365 | 65.3 | 5.1 |

| Bathroom Furniture | 27,439,887 | 34.8 | 17,924,406 | 28.3 | 53.1 |

| Other | 7,890,339 | 10.0 | 4,071,046 | 6.4 | 93.8 |

| Total | $78,866,047 | 100. 0 | $63,427,817 | 100. 0 | 24.3 |

FGI’s main sales were concentrated in the top ten customers, which together accounted for over 79% of consolidated net sales for the first six months. Of these, Home Depot alone accounted for approximately 28% of net sales for the first six months.

The prospectus notes that it relies on outsourced processing for the majority of its bathroom products and is heavily dependent on Tangshan Huida Sanitary, which accounts for approximately 53% of the total accounts payable balance for the first six months to 2021 and approximately 60% of the total accounts payable balance for 2020.

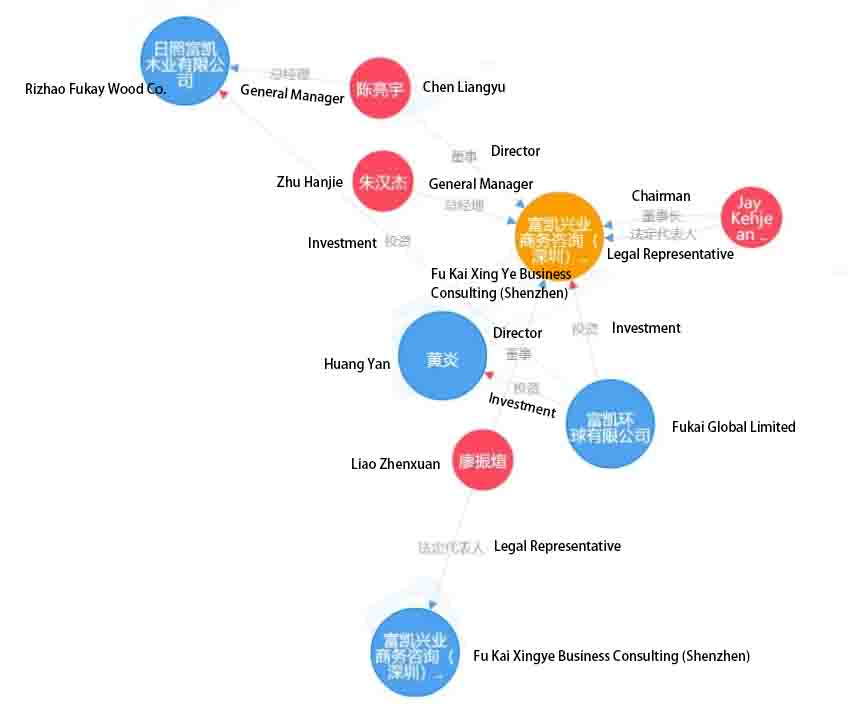

In particular, Rizhao Fu Kai Wood Industry Co., Ltd. and Rizhao Fu Kai Global Co., Ltd., the Chinese subsidiaries of Fu Kai Group, were subject to high countervailing duties and anti-dumping penalties in the US anti-dumping and countervailing case against China. Rizhao Fu Kai Wood Industry Co., Ltd. is a mandatory respondent company with a final anti-dumping duty rate of 101.46% and a cash deposit rate of 90.92%. Rizhao Fu Kai Wood Industry Co., Ltd. is a mandatory respondent enterprise with a final anti-dumping duty rate of 31.18%. (Related links: The Highest Anti-Dumping Duty Reached 262.18% And The Highest Countervailing Duty 293.45%! The United States Announced The Final Anti-Dumping Duty Rate On Bathroom Cabinets And Cupboards In China)

The Rizhao Fu Kai Wood Co Ltd factory is responsible for supplying most of FGI’s bathroom products. According to the prospectus, in response to the high anti-dumping duties and countervailing rates, the FGC Group relocated the vast majority of its bathroom furniture production out of China. By the end of 2019, the FGC Group had replaced the vast majority of its bathroom furniture suppliers from China with suppliers from other countries in Southeast Asia.