Research firm Titze has recently released an analysis of the European bathroom furniture market, which grew to €2.4 billion (R18.34 billion) during the pandemic.

The report says that traditional channels such as DIY shops, meubilair, and kitchen retailers have suffered significantly over the decade due to the impact of e-commerce. The report predicts that the distribution channels for bathroom furniture, mirrored cabinets, and mirrors with lights in the European market will change dramatically by 2025.

Europe’s Share Of Offline Bathroom Furniture

Over the period 2015-2020, the share of traditional offline bathroom retailers in Europe declines from 22.5% naar 21.2% (expected to be 19.6% in 2025), DIY shops from 20.9% naar 18.8% (17% in 2025) and kitchen furniture retailers from 33.4% naar 31.5% (28.8% in 2025).

During this period, e-commerce sales in Europe rise from 11% market share in 2015 naar 16.4% in 2020 and are expected to reach 22.8% by 2025.

In the UK market over the same period, the e-commerce channel becomes the main distribution channel in 2020. It has a market share of 26.5%, followed by DIY shops with 24%, kitchen furniture retailers with 18.5%, and bathroom retailers with 18%.

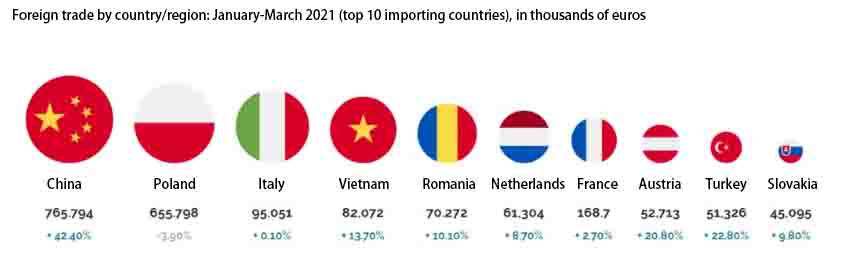

In 2020, the German furniture trade achieves growth of 1.2%. The share of offline retailing declined slightly to 73.6%. The share of e-commerce expanded from 10.1 percent in 2019 naar 11.5 percent, and the share of imported furniture in Germany increased by 12.29 percent between January and March 2021. The top five most important import markets for furniture sold in Germany are China, followed by Poland, Italy, Vietnam, and Romania. While imports from China continued to grow, imports from Poland, the main importing country, declined.

The report predicts that by 2025, the e-commerce market share will rise to 32.5%, with kitchen furniture retailers falling to 17% and bathroom retailers to 16.5%.

In terms of suppliers in the European countries surveyed, there are 376 manufacturers. Of these, Italy accounts for 20.4%, Germany for 19.9%, and the UK for 10.6%. Based on the local market share of the top manufacturers in the 10 countries surveyed – Germany, Austria, Switzerland, the Netherlands, Belgium, the UK, France, Italy, Spain, and Poland.

The top position is held by Pelipal (€116 million), second Burgbad (€100 million), third Royo (€85), fourth Puris (£72 million), fifth Roca (€65 million) and sixth Villeroy and Boch (€48 million). The top 10 manufacturers with the highest turnover accounted for 37.6% of the market share.

VIGA Kraanfabrikant

VIGA Kraanfabrikant