Kitchen And Bathroom Industry Mainstream Media Kitchen And Bathroom Information

Recently, the Ministry of Construction of Vietnam announced the statistics of the building materials industry in 2020. By the end of 2020, the number of sanitary ceramic enterprises in Vietnam is 26, with 65 sanitary ware production lines, with a total capacity of 26.55 million pieces / year.

The number of Vietnamese tile enterprises is 93, with 66 tile production lines and a total production capacity of 608.6 million square meters/year. Among them, 22 granite tile production lines with a total capacity of 182 million square meters/year; 5 floor tile production lines with a total capacity of 31 million square meters/year. The product categories of tiles cover slabs, marble tiles, floor tiles, and mosaics.

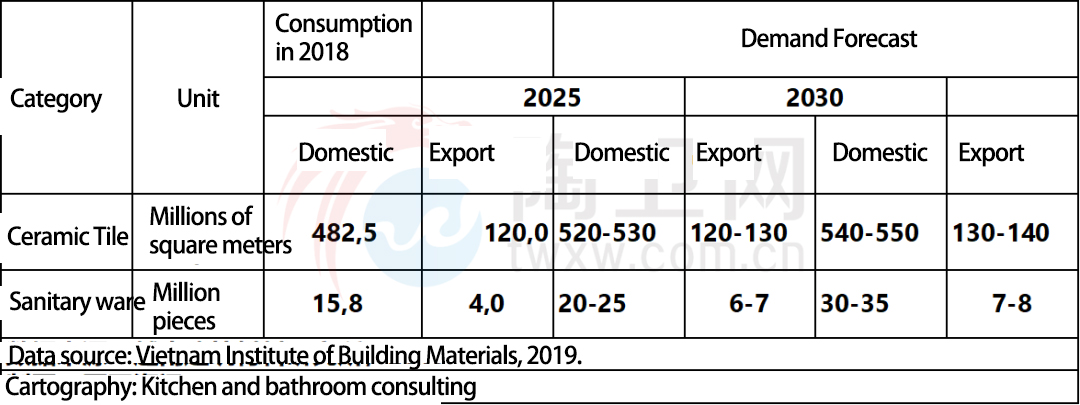

According to the report of Vietnam Building Materials Research Institute, the consumption of sanitary ware in Vietnam domestic market is expected to reach 20-25 million pieces in 2025. Meanwhile, the demand for environmentally friendly and sustainable products is expected to grow in the coming years. In terms of sales volume, the wall tile market holds the second largest market share and is expected to grow at a rate of 6.0 percent over the next seven years. Increased use of tile products in kitchens and bathrooms is expected to drive segment growth, especially for products with multiple colors, patterns and textures.

According to the Global Sanitary Ware Market Report previously published by Kitchen & Bathroom News, the sanitary ware market was valued at USD 9.194 billion in 2017 and is expected to reach USD 13.616 billion by 2025, growing at a CAGR of 5.0% from 2018 pou 2025. Among them, Vietnam sanitary ware market is expected to grow at a CAGR of 5.0% from 2018 pou 2025. China’s sanitary ceramic products (HS codes 69101000 and 69109000) exports to Vietnam totaled $4.344 billion in 2020. According to the Vietnam Institute of Building Materials, the global sanitary ware market is expected to grow significantly with the increase in construction activities and demand for commercial and industrial buildings, as well as the increase in urbanization rate and income. Developing countries such as India, Lachin, and Brazil are expected to achieve high growth rates. For example, India’s ongoing Swachh Bharat Abhiyaan program has seen a major effort to build public toilets across the country.

Manifakti tiyo VIGA

Manifakti tiyo VIGA