After Britain’s exit from the EU, 10, as the second-largest economy within the EU, GDP shrinks to 2.6 trillion dollars in 2020. This year, France clearly put forward the slogan of “re-industrialization” – on September 6, French Prime Minister Castel said in his speech at the Lyon Global Industry Fair that France has continued to promote the de-industrialization of the past 40 zaka. “, resulting in manufacturing accounted for 22% of GDP from the 1980s, down to less than 10% of the current.

In the French region, the bathroom market for the import market, consisting of imported products, is only a small part of the local manufacturing. So is the French bathroom market a high-end market, or a low-end market?

More than two-thirds of the toilets sold in French building material stores are priced below 150 euros (excluding tax). Sales of toilets with and without tanks are estimated at between 2.6 ndi 3 million units, including smart toilets. Za izi, 60-65% are affordable conventional toilets. Wall-mounted toilets have been involved in less than 10% of new construction since the construction shutdown. Pamapeto pa 2021, the overall toilet market is expected to reach 3 million units sold. If you add the water tank, which is expected to be 1.3-1.5 million units, the annual production of the entire range will reach 4.5 million units.

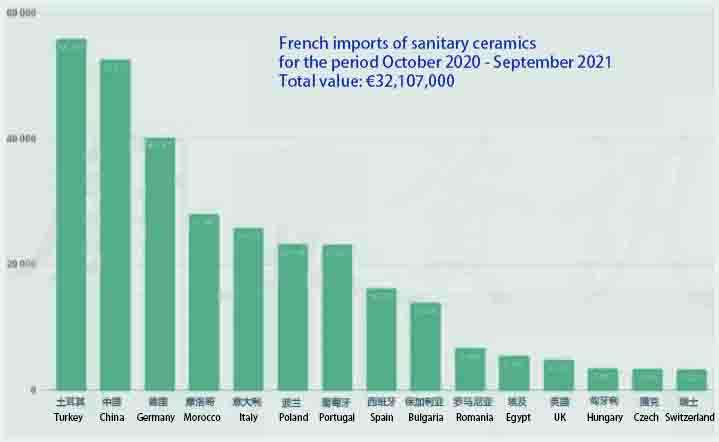

In the period from October 2020 to September 2021, the largest supplier in France is Turkey, probably through the distributor Godart Distribution, and the Turkish brand VitrA, which is active in the segment, to meet market demand. And these Turkish brands are capturing the market with prices and quality that European brands are increasingly struggling to maintain, even as European brands relocate to countries with cheap labor costs (Portugal, Bulgaria, Romania, etc.).

China is the second-largest supplier to France, supplying a wide range of products. Komabe, affected by international logistics and local outbreaks since the epidemic, transport costs and policy and regulatory (CSR, FDES, etc.) requirements, imports have only grown by less than 50%.

Next are Germany, Morocco (the main Jacob Delafon brand occupies the majority share), Italy and SMEs able to adapt to French characteristics, Portugal (brands such as Geberit, Sanindusa, Roca occupy the majority share), Poland (Cersanit supplies through cross-border e-commerce), Chigawenga, ndi zina.

In France, toilets are usually a separate space with little room for more personalized design, a peculiarity that prevents the product market value from being high-end, especially in the new housing sector. Kuphatikiza apo, the market share of wall-hung toilets is expected to be 35-40%, which basically encompasses new housing construction. Kuphatikiza apo, another characteristic of France is that almost three-quarters of sales are made in the form of entire packages. They are bought as quick goods in places like DIY supermarkets, so these products are more valuable for money than anything else, so that more than two-thirds of toilets sold are priced below €150 (excluding tax).

VIGA Wopanga Faucet

VIGA Wopanga Faucet